Diffculty Finding and Understanding Cost Obligations Contributes to Healthcare Affordability Woes in Wisconsin

A 2022 survey of more than 1,100 Wisconsin adults found that residents face heavy healthcare

affordability burdens, and that affording healthcare in the future is a top consumer concern.1 Using data from the same survey, this data brief explores how Wisconsin residents navigate the health system and understand their cost obligations.

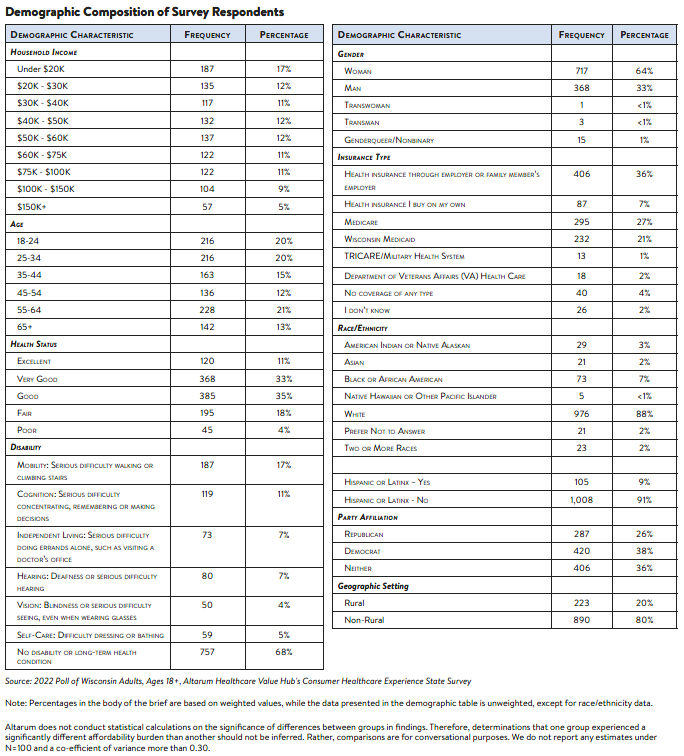

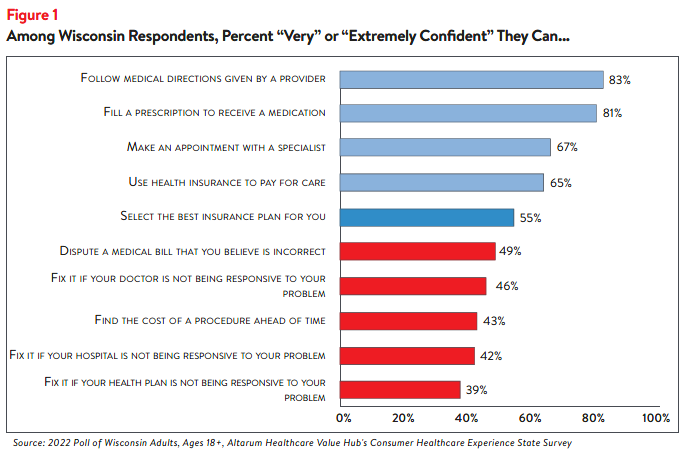

Out of 21 tasks, Wisconsin residents have the least confidence when it comes to correcting billing

issues or working with their doctor, hospital or health plan to solve problems.

Wisconsin residents report being confident they can follow the directions provided by their doctor

or fill a prescription (Figure 1). However, they are far less confident when dealing with cost issues,

such as disputing a medical bill error or finding out the cost of a procedure ahead of time. Fewer than

half of Wisconsin adults are confident they can take steps to fix a problem if their doctor, hospital or

health plan is not responsive to their concerns (46%, 42% and 39%, respectively).

Despite these concerns, some respondents report they feel more confident that they can navigate

the healthcare system than afford the care they receive. For example, only 38% of respondents were

somewhat or very confident that they could afford to pay for a major illness.2

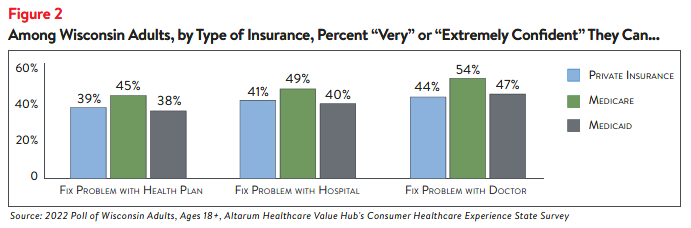

For the most diffcult tasks, respondents generally report similarly low rates of confidence, regardless

of insurance type (Figure 2). However, those who use Medicare reported slightly higher levels of

confidence across each of these tasks, compared to respondents with different types of insurance.

This data is consistent with CHESS survey findings, not only in Wisconsin but in other states as well,

which show that among privately insured adults, respondents often only took the simplest actions

to address healthcare challenges such as contacting their health plan, doctor or hospital.3

However, respondents almost never escalated their efforts to include contacting a state agency, filing an appeal or other steps. Many reported being dissatisfied with the resolution of their surprise bill.

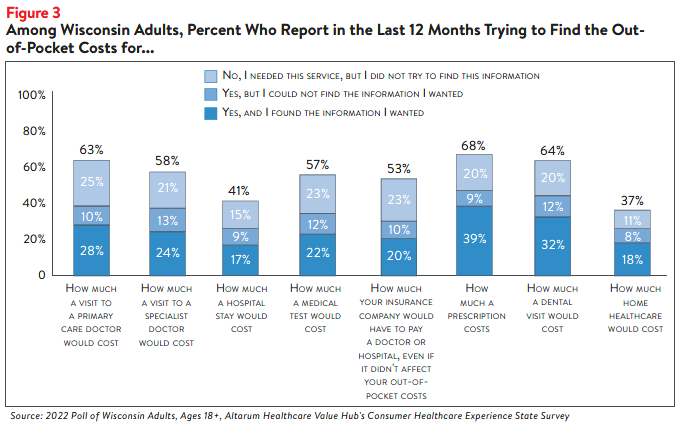

Wisconsin Respondents May Not Know Where to Find Price Information

Less than half (43%) of Wisconsin adults are confident they can find the price of a procedure ahead

of time (Figure 1)—this comports with the price-seeking behavior reported in the survey (Figure 3).

Respondents who reported engaging in price-seeking behavior but could not find the information

they wanted indicated that the barriers to finding this information included: The resources available

to research price information were confusing (43%); the provider (which includes doctor/hospital/

pharmacy/dentist/home health provider) would not give me a price estimate (39%); the price

information available was not suffcient (30%); my insurance plan would not give me a price estimate

(28%).

Of those respondents who report needing the service but did not try to find price information,

reasons most often selected included: I followed my doctor’s recommendation (39%); I didn’t know

where to look (29%); looking for the information felt too confusing or overwhelming (26%); and I

didn’t have time to look (20%).

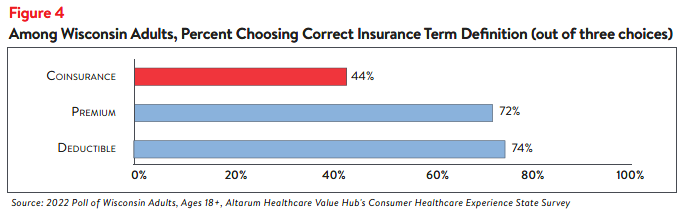

Health Plan Cost-Sharing Terms are Difficult to Understand

Despite this price-seeking behavior, consistently understanding cost-sharing obligations remains

challenging for Wisconsin respondents.

When given multiple choices, respondents were able to choose the correct definitions for

“Deductible” 74% of the time, but less than half had an accurate understanding of “Coinsurance”

(Figure 4).

This comports with national studies which found that health plan cost-sharing terms are very diffcult

for consumers to understand. Reasons for this include complex insurance rules, poor numeracy skills

and poor literacy skills.4 Information related to patients’ out-of-pocket costs was rated as the most

challenging to find and understand out of all healthcare information.5

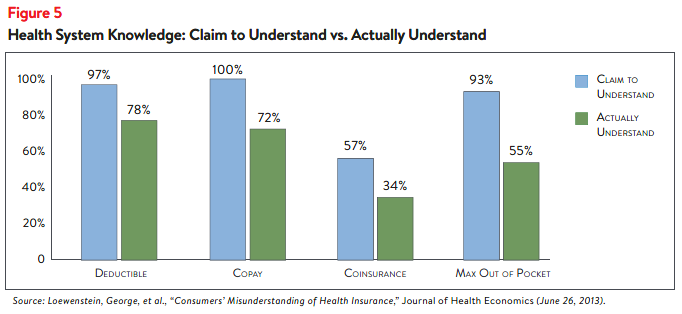

Unfortunately, national data suggests that consumers are not good self-reporters when it comes to

assessing their skills. Studies, like the one in Figure 5, show that confidence typically exceeds actual

skills, particularly when it comes to applying insurance cost-sharing rules to understand the amount

patients have to pay.6

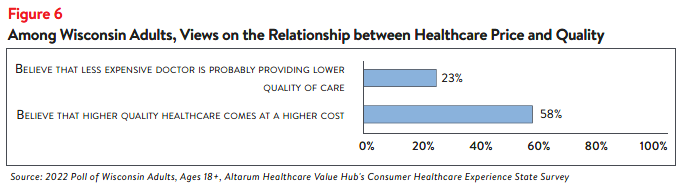

Relationship Between Quality and Price

In light of well-documented, wide-spread variation in clinical quality and price,7 it is clear that consumers can benefit if they can successfully identify providers and treatment options that are of “good value.” Furthermore, studies show there is little relationship between the quality and price of a medical service.8

This survey investigated respondents’ own views on the relationship between quality and price.

More than half of Wisconsin respondents (58%) believe that higher quality health care usually comes

at a higher cost, yet very few believe that prices reliably signal the quality of care. Just 23 percent

believe that a less expensive doctor is likely providing lower-quality care (Figure 6).

Both cost and quality are important to Wisconsin respondents. More than half of Wisconsin

respondents (54%) indicated that if two doctors or health care providers had equal quality ratings,

out-of-pocket costs would be a very or extremely important factor in deciding between the two

professionals. Conversely, 56 percent of respondents indicated that if two doctors’ out-of-pocket

costs were equal, quality ratings would be a very or extremely important factor in deciding between

the two professionals.

Discussion

Wisconsin respondents are knowledgeable about the relationship between the cost and quality

of healthcare, and seemingly willing to seek out-of-pocket cost data. Yet they also report lacking

confidence in certain skills needed to navigate the healthcare system. The most common struggles

reported include an inability to successfully dispute medical bills and resolve problems with

unresponsive providers, health plans and hospitals. These navigational challenges do not vary

substantially by insurance type, suggesting that these diffculties are not isolated to a specific

insurance type.

Low understanding of coinsurance and other challenges can make it diffcult for consumers to

anticipate out-of-pockets costs in order to budget for expenses. Moreover, these diffculties may

contribute to the receipt of “surprise medical bills” and worsen affordability burdens and worries of

consumers.9,10

Consumer harm that results from diffculty navigating the health system can be addressed in

numerous ways. Evidence to date suggests that simplifying eligibility, benefit design and other

aspects of our health system are likely to yield better results than educational efforts alone.

Simplification strategies that have been tried in other states include:

- Reducing the likelihood of encountering pricing or quality outliers;11

- Simplifying and standardizing cost-sharing benefit designs;12

- Providing “nudges” like integrated provider directories, quality rankings and out-of-pocket calculators at the point of health plan shopping;

- Providing live, hands-on assistance navigating health insurance issues; and

- Deploying “Universal Precautions” in communications

Similarly, to the extent that the health system remains complex, consumers have signaled a

preference for live, just-in-time consumer assistance as opposed to passive educational materials.13

A few states have developed a one-stop-shop for helping consumers address denied claims or other

diffculties.14

Notes

- For more information, see Wisconsin Residents Struggle to Afford High Healthcare Costs; Support for a Range of Government Solutions Across Party Lines, Healthcare Value Hub, Data Brief No. 137 (January 2023).

- Ibid.

- For a listing of Healthcare Value Hub Consumer Healthcare Experience State Survey briefs focused on surprise medical bills please visit https://www.healthcarevaluehub.org/advocate-resources/consumer-healthcare-experience-state-survey?pub_topic=Surprise%20Medical%20Bills.

- Long, S. et. al. Low Levels of Self-Reported Literacy and Numeracy Create Barriers to Obtaining and Using Health Insurance Coverage, The Urban Institute, Washington, D.C. (October 2014). https://www.urban.org/sites/default/files/publication/49821/low-levels-of-self-reported-literacy-and-numeracy.pdf

- Duke, Chris, The Challenge of Communicating Health Care Information Effectively, Altarum Institute (Aug. 22, 2016) and Quincy, Lynn, What’s Behind the Door: Consumers’ Diffculties Selecting Health Plans, Consumers Union (January 2012).

- Paez, Kathryn, and Coretta, Mallery, A Little Knowledge Is a Risky Thing: Wide Gap in What People Think They Know About Health Insurance and What They Actually Know, American Institute for Research (AIR), Arlington, VA (October 2014).

https://www.air.org/sites/default/files/Health%20Insurance%20Literacy%20brief_Oct%202014_amended.pdf - Zack Cooper, et al., The Price Ain’t Right? Hospital Prices and Health Spending on the Privately Insured, Health Care Pricing Project, http://www.healthcarepricingproject.org/papers/paper-1

- Hussey, P., Wertheimer, S., and Mehrotra, A. “The Association Between Health Care Quality and Cost: A Systematic Review,” Annals of Internal Medicine (2013). https://pubmed.ncbi.nlm.nih.gov/23277898/

- Wisconsin Residents Struggle to Afford High Healthcare Costs; Express Bipartisan Support for a Range of Government Solutions, Healthcare Value Hub, Data Brief No. 137 (January 2022).

- The federal No Surprises Act prohibits surprise medical billing in most plans effective January 2022. However, it does not cover ground ambulances, which often result in surprise bills, and consumers may remain vulnerable to billing errors and forms allowing them to ”opt-out” of these federal protections. Further study is needed to determine the impact of the No Surprises Act on surprise medical billing.

- Vestal, Christine, One State’s Hospital Cost Solution: Regulated Prices, PEW Charitable Trusts, Philadelphia, P.A. (March 2011). http://www.pewtrusts.org/en/research-andanalysis/blogs/stateline/2011/03/29/one-states-hospital-cost-solution-regulated-prices

- Improving Value: Standard Benefit Design, Altarum Healthcare Value Hub, Ann Arbor, MI. https://www.healthcarevaluehub.org/improving-value/browse-strategy/standard-health-plan-designs

- Tolbert J, Perry M, Dryden S, Perry K., Connecting Consumers to Coverage: Lessons Learned from Assisters for Successful Outreach and Enrollment, Kaiser Family Foundation, San Francisco, CA (2014). https://www.kff.org/health-reform/issue-brief/connecting-consumers-to-coverage-lessons-learned-from-assisters-for-successful-outreach-and-enrollment/

- The Offce of Healthcare Advocate: Giving Consumers a Seat at the Table, Altarum Healthcare Value Hub, Ann Arbor, MI (May 2018). https://www.healthcarevaluehub.org/advocate-resources/publications/office-healthcare-advocate-giving-consumers-seat-table

Methodology

Altarum’s Consumer Healthcare Experience State Survey (CHESS) is designed to elicit respondents’ unbiased views on a wide range of health system issues, including confidence using the health system, financial burden and possible policy solutions.

The survey used a web panel from Dynata with a demographically balanced sample of approximately 1,196 respondents who live in Wisconsin. The survey was conducted in English or Spanish and restricted to adults ages 18 and older. Respondents who finished the survey in less than half the median time were excluded from the final sample, leaving 1,113 cases for analysis. After those exclusions, the demographic composition of respondents was as follows, although not all demographic information has complete response rates: