Louisiana Survey Respondents Have Difficulty Navigating the Health Care System, Understanding Cost-Sharing Obligations; Express Bipartisan Support for Government Action

A 2023 survey of more than 1,400 Louisiana adults, conducted from July 11 to July 24, 2023, found that

many respondents face challenges confidently navigating the health care system and understanding their

cost-sharing obligations. These challenges are sometimes attributed to low levels of health insurance

literacy.1 Inadequate health literacy2 (a closely related concept) has been associated with poorer health

outcomes, lower patient satisfaction, and higher costs.3 This brief surfaces respondents’ experiences

operating within the health care system, along with support for related policy solutions.

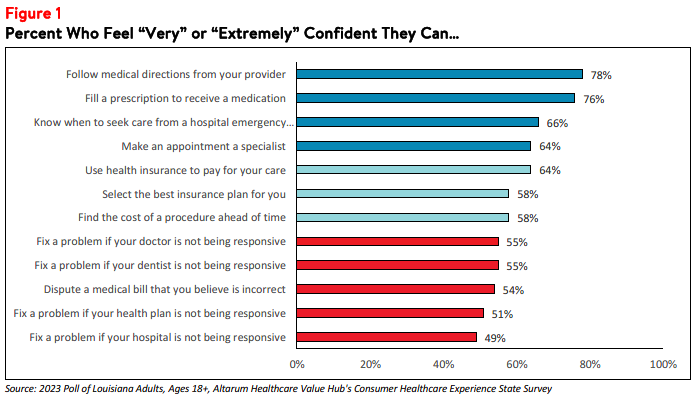

Confidence in Obtaining Care, Navigating Costs, & Resolving Issues

Many Louisiana respondents report being confident in their ability to follow the directions provided by

their doctor or fill a prescription (see Figure 1). However, they are far less confident when dealing with

cost issues, such as disputing a medical bill or finding out the cost of a procedure ahead of time. In

addition, roughly half of respondents are confident they can take steps to fix a problem if their doctor,

hospital, or health plan is not being responsive to their concerns.

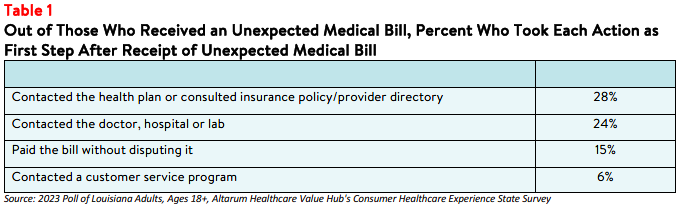

This data supports findings that respondents are frequently not confident in their ability to navigate

various aspects of the health care system and may be unprepared to manage challenging outcomes, such as unexpected medical bills. Among those who received unexpected medical bills in the past 12 months, 15% reported paying the bill without disputing it. Some reported taking initial steps like contacting their health plan (28%) or contacting their doctor, hospital, or lab (24%), but very few took additional steps

such as contacting a consumer assistance program (6%), filing an insurance appeal (3%), or contacting a

state government agency (3%). Ultimately, 29% report being dissatisfied with the resolution of their

unexpected bill (see Table 1).

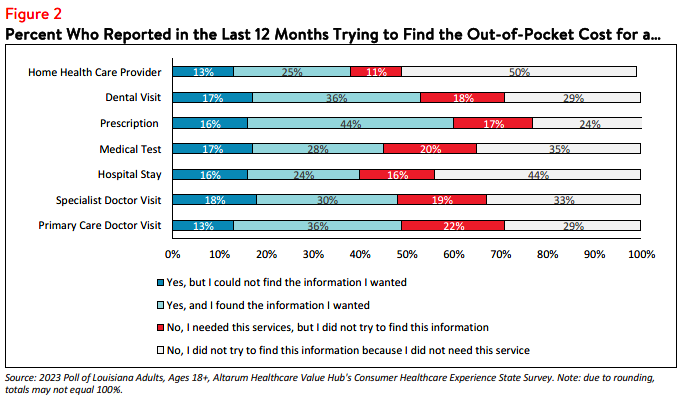

Success in Finding Health Care Price and Quality Information

Just over 2 in 5 (42% of) respondents were not confident that they could find the cost of a procedure

ahead of time. While many respondents who searched for price and quality information successfully found

the information that they were looking for, there were still respondents who either could not find the cost

information they were looking for or did not look for cost information ahead of time even though they

needed a service (see Figure 2).

The most frequent reasons respondents reported not seeking out price or quality information were:

- 32% – Followed a doctors’ recommendations or referrals

- 29% – Did not know where to look

- 21% – The act of looking for information felt confusing or overwhelming

Notably, few of these respondents reported that out-of-pocket cost or quality were unimportant to them

(9% and 5%, respectively). These reasons could also be influenced by this information not being accessible, despite federal price transparency mandates for hospitals.4

Respondents who attempted to find hospital cost or quality information but were unsuccessful reported

facing a variety of barriers. Many respondents who were unsuccessful in their search for cost information

reported that the available resources showing cost information were confusing (27%), their insurance plan

or their provider/doctor/hospital would not give them a price estimate (34% and 36%, respectively), and

that price information was insufficient (21%). In unsuccessful searches for hospital quality information,

respondents reported that resources available to search for quality information were confusing (20%) and

that the quality information available was not sufficient (15%).

Lack of knowledge of hospital quality and potential costs may impede consumers’ ability to plan for

needed care and budget for the expense of a hospital stay, which can be costly, 5 particularly for those who are un- or under-insured.

Difficulty Understanding Common Health Care Terms

Consistently understanding common health care system terms and cost-sharing obligations remains

challenging for many Louisiana respondents.

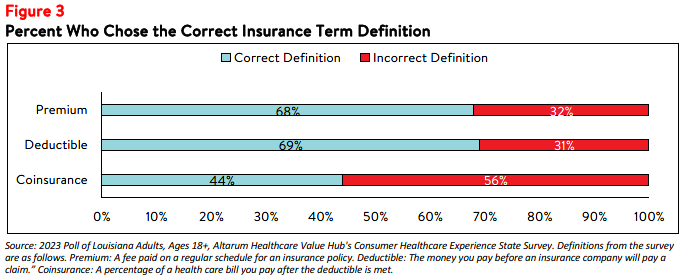

When given multiple choices, respondents were able to choose the correct definitions for premium and

deductible over two-thirds of the time, but less than half were able to accurately define coinsurance (see

Figure 3). This aligns with a national study that found half of insured adults say they find at least one

aspect of how their insurance works—such as what it covers, what their out-of-pocket costs will be, and

common terminology—at least somewhat difficult to understand. 6 Ultimately, difficulty understanding

cost-sharing terms and other components of the system may make it harder for consumers to navigate

the health care system, get needed care, and anticipate the out-of-pocket costs they will be expected to

pay. Efforts to improve health insurance literacy may address this consumer hindrance.

There is also a lack of consensus on the definition of health care quality: 43% of respondents indicated that they believe that health care quality refers to how doctors and office staff treat patients, such as bedside manner, while other respondents indicated that they believe health care quality refers to doctors and hospitals being credentialed and following evidence-based guidelines (30%) or how quickly and how well the patient recovers (27%). This lack of consensus on defining health care quality may impact how

consumers interpret transparency tools and quality information, adding to the confusion and complexity

of navigating the health care system.

Relationship Between Quality and Price

Studies show there is little relationship between the quality and the price of a medical service7 and few

respondents (30%) believe that a less expensive doctor is providing lower-quality care. However, nearly

two-thirds (63%) of Louisiana respondents believe that higher quality health care usually comes at a higher cost and 41% reported that they would be willing to pay more to see a doctor with higher quality ratings.

Both cost and quality are important to Louisiana’s health care consumers. Half (50%) of Louisiana

respondents indicated that, if two doctors or health care providers had equal quality ratings, out-of-

pocket costs would be a very or extremely important factor in deciding between the two professionals.

Conversely, 51% of respondents indicated that, if two providers’ out-of-pocket costs were equal, quality

ratings would be a very or extremely important factor in deciding between the two professionals.

Unexpected Medical Bills

Twenty-six percent of Louisiana adults reported receiving an unexpected medical expense in the prior 12

months. The rate was highest among respondents with health insurance they purchase on their own (33%), compared to those with Medicare (30%), insurance through their employer (26%), or Louisiana Medicaid (21%).

These unexpected bills take different forms. Of the respondents reporting that they received an

unexpected bill:

- 46% - reported the amount charged was higher than expected; and

- 32% - reported a bill from a doctor they didn’t expect.

Smaller numbers reported being charged out-of-network rates when they thought the doctor was in-

network (16%), being charged for services they did not receive (6%), or experiencing something else

unexpected (20%). As noted above, over eight out of ten (85%) Louisiana respondents who received a

surprise bill attempted to resolve the bill before paying it. As a first step, 24% contacted the doctor,

hospital, or lab and 28% contacted their insurance plan to resolve their unexpected medical bill (Table 1).

Over half (51%) of Louisiana respondents with an unexpected medical bill took more than one step to

resolve the unexpected bill. However, either as a first or second step, very few reported using any of the

following strategies to resolve their bill:

- Contacting an insurance broker;

- Filing an insurance appeal;

- Contacting state legislators or member of Congress;

- Contacting a lawyer; or

- Filing a formal complaint.

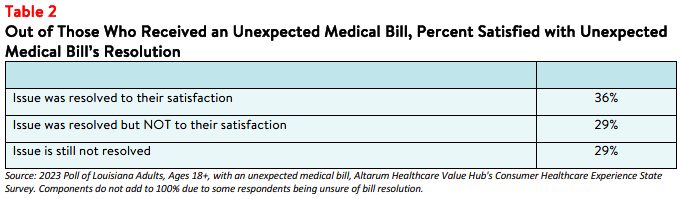

Among Louisiana adults who had an unexpected medical bill, 36% indicated that the issue was resolved to their satisfaction. Twenty-nine percent report that the issue was not resolved to their satisfaction. For

another 29%, the issue had not been resolved (see Table 2).

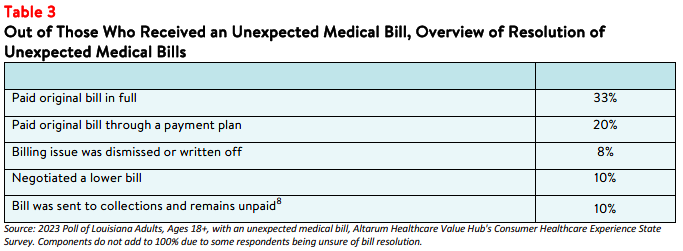

For those whose bill was resolved by the time of the survey, most paid the bill in full or through a payment

plan. A minority got relief from the bill, either by negotiating a lower bill or having the bill dismissed (see

Table 3). Two percent had their bill sent to collections.

High numbers of both satisfied and dissatisfied respondents report attempting to contact their health

plan, doctor, hospital, or lab to resolve the unexpected bill. However, consumers satisfied with how their

medical bill was resolved reported having tried other strategies, such as filing an appeal. In contrast,

consumers who reported being dissatisfied with how their medical bill was resolved more often reported

paying their bill without disputing it. Perhaps not surprisingly, those that felt satisfied with how their

medical bill was resolved were more likely to have either negotiated a lower payment or had their bill

written off or dismissed.

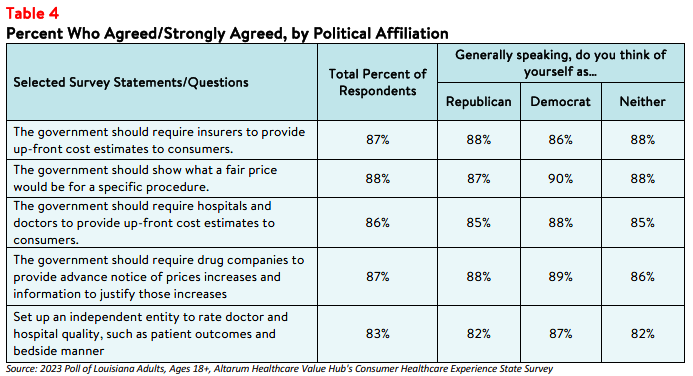

Support for Solutions Across Party Lines

When it comes to tackling problems in the health care system, respondents endorsed a number of

transparency-oriented strategies, including:

- 88% – Show what a fair price would be for specific procedures

- 87% – Require drug companies to provide advanced notice of price increases and information to justify those increases

- 87% – Require insurers to provide up-front cost estimates to consumers

- 86% – Require hospitals and doctors to provide up-front cost estimates to consumers

- 83% – Set up an independent entity to rate doctor and hospital quality, such as patient outcomes and bedside manner

Moreover, respondents endorsed these approaches across party lines (see Table 4).

Discussion

While Louisiana respondents report confidence in their ability to follow directions from their doctor or fill

a prescription, they are less confident when dealing with cost issues and resolving problems with

providers, health plans, and hospitals. Furthermore, consumers’ poor understanding of some common

terms may make it difficult to anticipate out-of-pockets costs and budget for health care expenses. These

difficulties may contribute to the receipt of unexpected medical bills, amplify affordability burdens, and

impede their ability to resolve the resulting bills to their satisfaction.

Price transparency tools can aid consumers by allowing them to plan for the expense of needed health

care services and may also enable state policymakers to address unwarranted price variation. However,

price transparency alone does not make markets more efficient, and transparency tools are generally not

successful at getting consumers to shop for lower-priced services.9 Instead, a combination of price

transparency tools and evidence-based policies should be used to increase health literacy across the state. Louisiana survey respondents endorsed a range of policy fixes that elected officials could pursue, both transparency- and non-transparency-related.

Notes

- A person's ability to seek, obtain, and understand health insurance plans, and once enrolled, use their insurance to seek appropriate health care services.

- A person’s ability to obtain, process, and understand basic health information and services needed to manage one’s health and make appropriate health decisions.

- Shahid, R., Shoker, M., Chu, L.M. et al. Impact of low health literacy on patients’ health outcomes: a multicenter cohort study. BMC Health Serv Res 22, 1148 (2022). https://doi.org/10.1186/s12913-022-08527-9

- As of January 1, 2021, the Centers for Medicare and Medicaid Services (CMS) requires hospitals to make public a

machine-readable file containing a list of standard charges for all items and services provided by the hospital, as well as a consumer-friendly display of at least 300 shoppable services that a patient can schedule in advance. However, Compliance from hospitals has been mixed, indicating that the rule has yet to demonstrate the desired effect. https://www.healthaffairs.org/content/forefront/hospital-price-transparency-progress-and-commitment-achieving-its-potential - According to Health Forum, an affiliate of the American Hospital Association, hospital adjusted expenses per inpatient day in Louisiana were $2,479 in 2021. See: Kaiser Family Foundation, State Health Facts Data: Hospital Adjusted Expenses per Inpatient Day, (Accessed Sept. 27, 2023).

- Pollitz, K., Pestaina, K., Montero, A., Lopes, L., Valdes, I., Kirzinger, A., Brodie, M., KFF Survey of Consumer Experiences with Health Insurance, (KFF, June 15, 2023) https://www.kff.org/report-section/kff-survey-of-consumer-experiences-with-health-insurance-methodology/ (Accessed September 26, 2023).

- "What Do We Know About Prices And Hospital Quality?", Health Affairs Blog, July 29, 2019.

https://www.healthaffairs.org/content/forefront/do-we-know-prices-and-hospital-quality (Accessed September 26,

2023). - Across all types of medical bills – expected and unexpected –involvement of a collection agency was common. Eleven percent of ALL LA adults have been contacted by a collection agency over a medical bill in the prior 12 months. See: Louisiana Respondents Struggle to Afford High Healthcare Costs; Express Across Party Lines Support for a Range of Government Solutions, Healthcare Value Hub, October 2023

- Benavidez G, Frakt A. Price Transparency in Health Care Has Been Disappointing, but It Doesn’t Have to

Be. JAMA. 2019;322(13):1243–1244. https://jamanetwork.com/journals/jama/fullarticle/2752049 (Accessed on

September 26, 2023).

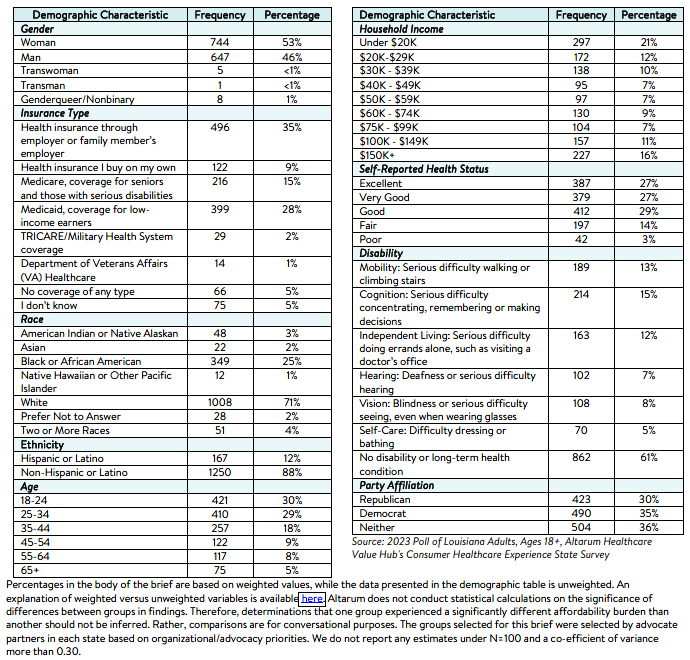

Methodology

Altarum’s Consumer Healthcare Experience State Survey (CHESS) is designed to elicit respondents’ unbiased views on a wide range of health system issues, including confidence using the health system, financial burden and possible policy solutions.

This survey, conducted from July 11 to July 24, 2023, used a web panel from online survey company Dynata with a demographically balanced sample of approximately 1,500 respondents who live in Louisiana. Information about Dynata’s recruitment and compensation methods can be found here. The survey was conducted in English or Spanish and restricted to adults ages 18 and older. Respondents who finished the survey in less than half the median time were excluded from the final sample, leaving 1,444 cases for analysis. After those exclusions, the demographic composition of respondents was as follows,

although not all demographic information has complete response rates: