Strategies to Address High Unit Prices: A Primer for States

Note: For an updated and expanded discussion on this topic see Research Brief No. 43, The Price Isn't Right: Strategies to Address High and Rising Healthcare Prices (March 2021).

Year-over year increases in the price of healthcare services are the predominant reason for our high growth in annual health spending, particularly in the commercial sector and for inpatient hospital services and prescription drugs.1 Policymakers need to consider a wide range of the health system issues, like addressing social determinants of health and encouraging adherence to treatment guidelines, but failure to address excess healthcare prices and price growth will ultimately undermine their efforts to create a patient-centered, high-value healthcare system.

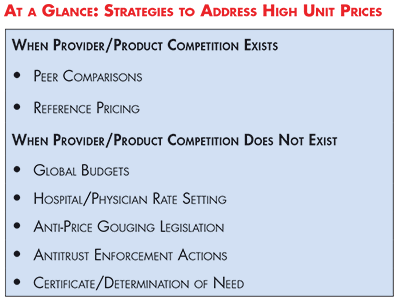

States are an important stakeholder when it comes to identifying high healthcare prices and, through their role as regulators and payers, are well positioned to address them. This brief explores state options for controlling healthcare costs and notes that policy options vary in effectiveness depending on the presence (or absence) of competition between providers, prescription drug companies and device manufacturers.

When are Prices Excessive?

When U.S. healthcare prices are compared to those in other countries or when healthcare price growth is compared to the growth of non-healthcare commodities, there is general agreement that prices seem excessive. But there is no universal consensus on the point at which healthcare prices become excessive. Early efforts to quantify excessive prices stem from the Institute of Medicine’s identification of “pricing failures” as a category of waste. Pricing failures occur when the price of a product or service exceeds “the cost of production plus a reasonable profit.” Using this definition, researchers estimated that excess prices added $84-$178 billion to healthcare spending in 2011.2

Commercial sector prices are often compared to Medicare prices in order to gauge reasonableness. For example, efforts around the country to address surprise medical bills often include a suggested amount that providers should be paid for a particular service, typically based on a multiple of what Medicare pays. Although Medicare’s payment systems are replete with critics, the program does make an effort to establish prices using the cost of production plus a reasonable profit.3

Another approach that tries to gauge the reasonableness of a price is “reference pricing,” which attempts to mitigate excessive prices by identifying unwarranted price variation within a geographic area and examining the distribution of prices to determine a reasonable (i.e., “reference”) price.

The Role of Concentrated Markets

Competition—or lack thereof—plays a large role in determining how much providers and drug and device manufacturers can charge for their products and services. It also affects the set of solutions available for states to address high and rising unit prices.

Provider consolidation through mergers and acquisitions increases the market power of providers and strengthens their ability to negotiate higher prices in their contracts with insurers, regardless of whether they provide higher quality care. A 2016 Federal Trade Commission report found that hospitals that held monopolies charged 15 percent more than those with four or more competitors. Hospitals with one or two competitors charged 5-6 percent more than those with four or more competitors.4

According to the Commonwealth Fund, the vast majority (90.1 percent) of provider markets (including hospitals, specialist physicians and primary care physicians) are either highly or “super” concentrated. The study found that providers’ bargaining power exceeded insurers’ in 58.4 percent of markets studied, whereas insurers’ bargaining power exceeded that of providers in only 5.8 percent of the markets.5

Similarly, drug manufacturers have been accused of charging exorbitant prices for drugs when competition is limited.6 Studies show that the prices of brand name drugs decline to nearly half their original cost after two generics enter the market, and a third of their original cost once five generics enter the market.7

Public scrutiny and concern has increased in recent years in response to growing evidence of anti-consumer and anti-competitive practices.

Strategies to Lower Prices: When Provider/Product Competition Exists

Forms of provider-facing price transparency can be effective means of discouraging pricing outliers when there are multiple competitors in a given market.

Peer Comparisons

Provider “peer comparisons” are commonly employed to control unnecessary utilization, but anecdotal evidence suggests that they can motivate high-cost providers to lower their prices as well.8 Prior to 2010, payments to New Hampshire’s most expensive hospital exceeded those of its competitors by nearly 50 percent. Historically, the state’s largest insurer had been unable to decrease prices due to the hospital’s prominent reputation and loyal, wealthy patient base. But evidence of excessive prices—made public on the state’s price transparency website—enabled the insurer to brand the hospital as a pricing outlier, garner public support and negotiate lower prices. Market observers testified that, despite limited public awareness of the price transparency tool, publicly identifying high-priced providers shifted the balance of power towards the state’s insurers and narrowed price variation over time.9

Reference Pricing

Reference pricing aims to contain healthcare costs by establishing a “reference price” that a payer will contribute towards the cost of a certain procedure and requiring patients to pay expenses in excess of the established amount.

While the primary goal of the strategy is to incentivize patients to seek care from lower- to moderately priced providers, a now famous study from the California Public Employees’ Retirement System (CalPERS) showed that high-priced providers of knee and hip replacement surgeries lowered their prices to meet the established rate in order to remain competitive.10 It is important to recognize, however, that reference pricing—like other forms of price transparency—could theoretically cause low-price providers to raise their prices to meet the market rate. However, this phenomenon has not been widely observed.11

States can increase the likelihood that reference pricing will effectively lower costs by focusing on procedures that are routine, elective and non-urgent; have high variation in prices; have little variation in quality; and are widely identified as the appropriate mode of treatment.12

Limitations

It is commonly argued that other strategies, like consumer-facing price transparency and provider payment reform are sufficient to lower excessive prices. While consumer-facing price transparency helps keep consumers safe in the marketplace, it does not put downward pressure on prices.13 Similarly, provider payment reforms, like pay for performance—which typically seek to improve outcomes and/or address utilization problems—have not been shown to address excess prices.

Finally, as demonstrated by the New Hampshire example above, the presence of more than one provider in a market does not always mean that the basic principles of competition are met. Specifically, having just a few competitors may not be enough to promote price competition. The same holds true for the pharmaceutical industry, where “shadow pricing” has occurred when lower-priced manufacturers have increased the price of a drug to align with higher-priced competitors.14 In these cases, states should look to the next set of solutions—strategies to lower prices when competition is scarce.

Strategies to Lower Prices: When Provider/ Product Competition Does Not Exist

Given the extreme concentration of many healthcare markets, states need solutions that don’t rely on the threat of taking business away from a provider or product manufacturer. The following strategies show potential to control high and rising healthcare costs, even in concentrated markets.

Global Budgets

Global budgets are a payment model in which providers—typically hospitals—are paid a prospectively-set, fixed amount for the total number of inpatient, outpatient and emergency services provided annually. Hospitals are responsible for expenditures in excess of the set amount in addition to quality outcomes, thus creating an incentive to reduce unnecessary utilization and invest in prevention.

Maryland has incorporated global budgets into its long-running all-payer rate setting program with notable success.15 Other states, like Pennsylvania, are now testing the utility of the model in a non-rate setting environment. Pennsylvania’s plan differs from Maryland’s in that it focuses exclusively on rural areas, which generally experience limited competition due to provider shortages. The Pennsylvania Rural Health Model is in the early stages of implementation and has yet to be evaluated.16

Hospital/Physician Rate Setting

In most states, providers negotiate the price of services with each commercial payer, dictate prices to uninsured individuals and take prices from Medicare and Medicaid—resulting in a vast array of prices being paid for a given service. Rate setting decreases price variation by establishing uniform rates for some or all payers.

For example, Maryland’s all-payer rate setting system for hospitals establishes uniform rates for services paid by all public and private payers operating in the state. As a result, all payers pay the same price for the same service at a given hospital. Evidence suggests that the program effectively limited growth in annual per capita hospital spending and resulted in considerable savings to the Medicare program from 2014-2016.17 Maryland has received federal approval to extend its all-payer model to non-hospital providers in 2019, on a voluntary basis.18

Vermont is in the early stages of all-payer rate setting for Accountable Care Organizations (ACOs), instead of hospitals. Beginning in 2017, all major payers—Medicare, Medicaid and Blue Cross Blue Shield of Vermont (the state’s dominant commercial insurer)—committed to paying participating ACOs19 using the same value-based reimbursement methodology, rather than the traditional fee-for-service. In addition to meeting outcome and quality targets, the state must demonstrate that the model limits annual per capita expenditure growth for Medicare and non-Medicare beneficiaries alike.20 An early evaluation of one of the state’s largest ACOs—OneCare Vermont—failed to demonstrate cost savings in the first year of implementation.21 However, additional studies will be required to see if the model effectively controls rising healthcare costs over time.

High and inconsistent hospital spending under Montana’s state employee health plan prompted the state to implement rate setting in 2016. Using Medicare rates as a baseline, the state established uniform prices for hospital services (priced at 234 percent of Medicare rates).22

Anti-Price Gouging Legislation

Pharmaceutical manufacturers and pharmacy benefit managers have come under fire for various practices that stifle competition and raise prices.23 In recent years, several states have introduced legislation to prevent harmful, and even unethical, activities such as “price-gouging”—when a manufacturer uses its competitive advantage to charge unreasonably high prices for “essential off-patent or generic drugs.” As of October 2018, Maryland is the only state to pass such legislation (applicable only to generic drugs), which was struck down on constitutional grounds.24 As of this writing, the state’s Attorney General has appealed the decision to the U.S. Supreme Court.

Antitrust Enforcement Actions

Antitrust laws prohibit certain anticompetitive behaviors, but they have been largely ineffective at preventing high levels of provider consolidation since the 1990s. Some state Attorneys General have sought to strengthen antitrust enforcement by using their authority to conduct investigations independently of the federal agencies charged with oversight—the U.S. Department of Justice and the Federal Trade Commission. For example, California’s attorney general sued Northern California’s largest health system—Sutter Health—accusing them of anticompetitive behavior that has driven up healthcare prices in the region.25

Certificate/Determination of Need

Certificate/determination of need (CON) regulations require healthcare providers—primarily hospitals—to demonstrate to a public body the clinical need for a capital expense, such as a new building or major piece of equipment, prior to making an investment. While primarily used as a strategy to address oversupply, there is some evidence to suggest that CON policies can reduce the cost of delivering healthcare if they are effectively structured. But mixed evidence on cost-containment suggests that other approaches—like global budgeting—may be needed to augment this strategy.

Conclusion

Researchers, policymakers and consumers have long been aware that healthcare prices are not commensurate with the quality of care and outcomes we receive. High unit prices strain the budgets of state and federal governments, crowding out other important investments, and burden consumers—the ultimate healthcare payers (through increased taxes, premiums, deductibles, etc.). Competition is ceasing to be an effective deterrent to excessive prices. Through their legislative and regulatory functions, states play an important role in tracking price growth, instances of price gouging or excessive prices and deploying appropriate strategies to address rising costs.

Notes

- Healthcare Cost Institute, 2016 Health Care Cost and Utilization Report, Washington, D.C. (2018).

- Lallemand, Nicole C., “Reducing Waste in Health Care,” Health Affairs (Dec. 13, 2012). https://www.healthaffairs.org/do/10.1377/hpb20121213.959735/full/

- Cubanski, Juliette, et al., A Primer on Medicare: Key Facts about the Medicare Program and the People it Covers, Kaiser Family Foundation, San Francisco, Calif. (March 20, 2015). https://www.kff.org/report-section/a-primer-on-medicare-how-does-medicare-pay-providers-in-traditional-medicare/

- RevCycleIntelligence, Healthcare M&A Leads to 90% of Markets Being Highly Consolidated, https://revcycleintelligence.com/news/healthcare-ma-leads-to-90-of-markets-being-highly-consolidated (accessed on Oct. 22, 2018).

- Fulton, Brent D., Daniel R. Arnold and Richard M. Scheffler, Market Concentration Variation of Health Care Providers and Health Insurers in the United States, The Commonwealth Fund, New York, N.Y. (July 30, 2018). https://www.commonwealthfund.org/blog/2018/variation-healthcare-provider-and-health-insurer-market-concentration

- Krishnan, Sunita, Prescription Drug Competition Hampered by Policies, Barriers and Delay Tactics, Altarum Healthcare Value Hub, Washington, D.C. (December 2017). https://www.healthcarevaluehub.org/advocate-resources/publications/prescription-drug-competition-hampered-policies-barriers-and-delay-tactics/

- Kaiser Health News, Government-Protected ‘Monopolies’ Drive Drug Prices Higher, Study Says, https://khn.org/news/government-protected-monopolies-drive-drug-prices-higher-study-says/ (accessed on Oct. 18, 2018).

- Hunt, Amanda, Non-Financial Provider Incentives: Looking Beyond Provider Payment Reform, Altarum Healthcare Value Hub, Washington, D.C. (February 2018). https://www.healthcarevaluehub.org/advocate-resources/publications/non-financial-provider-incentives-looking-beyond-provider-payment-reform/

- Quincy, Lynn, and Amanda Hunt, Revealing the Truth about Healthcare Price Transparency, Altarum Healthcare Value Hub, Washington, D.C. (June 2018). https://www.healthcarevaluehub.org/advocate-resources/publications/revealing-truth-about-healthcare-price-transparency/

- Robinson, James, and Timothy Brown, Evaluation of Reference Pricing: Final Report, letter to David Cowling of CalPERS (May 15, 2013).

- Altarum Healthcare Value Hub, Reference Pricing, https://www.healthcarevaluehub.org/improving-value/browse-strategy/reference-pricing/ (accessed on Oct. 18, 2018). See also: Quincy and Hunt (June 2018).

- Slevin, Geraldine, and Julie Silas, Creating a Consumer-Friendly Reference Pricing Program, Consumers Union, Yonkers, N.Y. (August 2014). https://consumersunion.org/wp-content/uploads/2014/08/Reference_pricing_principles_814.pdf

- Krishnan (December 2017).

- Quincy and Hunt (June 2018).

- Cohen, Stephanie, and Erin Butto, Hospital Rate Setting: Promising, but Challenging to Replicate, Altarum Healthcare Value Hub, Washington, D.C. (August 2017). https://www.healthcarevaluehub.org/advocate-resources/publications/hospital-rate-setting-promising-challenging-replicate/

- Altarum Healthcare Value Hub, State Strategies to Better Healthcare Value, https://www.healthcarevaluehub.org/advocate-resources/key-state-strategies-better-healthcare-value/ (accessed Oct. 18. 2018).

- Cohen and Butto (August 2017).

- Office of Governor Larry Hogan, “Governor Larry Hogan Announces Federal Approval of “Maryland Model” All-Payer Contract,” News Release (May 14, 2018). https://governor.maryland.gov/2018/05/14/governor-larry-hogan-announces-federal-approval-of-maryland-model-all-payer-contract/

- Participation in the model is voluntary for providers and non-major payers

- Centers for Medicare & Medicaid, Vermont All-Payer ACO Model, https://innovation.cms.gov/initiatives/vermont-all-payer-aco-model/index.html (accessed on Oct. 23, 2018).

- Hostetter, Martha, Sarah Klein and Douglas McCarthy, Vermont’s Bold Experiment in Community-Driven Health Care Reform, The Commonwealth Fund (May 10, 2018). https://www.commonwealthfund.org/publications/case-study/2018/may/vermonts-bold-experiment-community-driven-health-care-reform?redirect_source=/publications/case-studies/2018/may/onecare-vermont

- “‘Holy Cow’ Moment Changes How Montana’s State Health Plan Does Business,” Kaiser Health News https://khn.org/news/holy-cow-moment-changes-how-montanas-state-health-plan-does-business/ (accessed on Oct. 26, 2018).

- Altarum Healthcare Value Hub, High Drug Spending: What’s the Prescription?, https://www.healthcarevaluehub.org/advocate-resources/high-drug-spending/ (accessed on Oct. 18. 2018).

- The 4th circuit court overturned the law on the grounds that it “regulates trade that happens beyond Maryland’s borders, and so is prohibited by the so-called dormant commerce clause.”

- Kaiser Health News, California Hospital Giant Sutter Health Faces Heavy Backlash On Prices, https://khn.org/news/california-hospital-giant-sutter-health-faces-heavy-backlash-on-prices/ (accessed on Oct. 22, 2018).

- Ferrier, Gary D., Hervé Leleu and Vivian G. Valdmanis, “The Impact of CON regulation on Hospital Efficiency,” Healthcare Management Science, Vol. 13, No. 1 (May 2009).

- Rosko, Michael D., and Ryan L. Mutter, “The Association of Hospital Cost-Inefficiency with Certificate-of-Need Regulation,” Medical Care Research and Review, Vol. 71, No. 3 (2014).

- Sass, Alex, Certificate of Need Regulations: Mixed Evidence for Cost Containment, Altarum Healthcare Value Hub (July 2015). https://www.healthcarevaluehub.org/advocate-resources/publications/certificate-need-regulations-mixed-evidence-cost-containment/#note1