Consumer-Centric Healthcare: Choosing a Health Plan

Healthcare is increasingly touted as consumer- or patient-centered. Research is beginning to show that revealing and catering to consumer preferences can lead to better outcomes, more efficient spending and higher patient satisfaction. But our health system too often fails to provide what consumers really want and need.

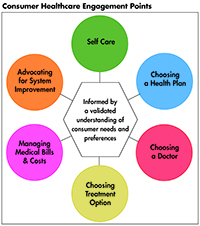

This Easy Explainer describes one of six consumer healthcare engagement points explored in the Hub’s Research Brief No. 18, Consumer-Centric Healthcare: Rhetoric vs. Reality, which outlines how these failings could be addressed and encourages a discussion of how to elevate, support and validate the consumer’s voice.

What are Consumers’ Preferences and Needs?

Health insurance is vital for the health and financial well-being of individuals and families. It is a choice that then affects the consumer’s subsequent choice of providers and cost of treatment options. But purchasing health insurance is an extraordinarily complex process.

Most consumers want health insurance-they don’t want to “go bare” and they don’t believe themselves to be invincible.1

When consumers search for health insurance, their top considerations are financial-affordability of monthly premiums, annual deductibles and annual caps on out-of-pocket expenditures.2 Despite advancements in how insurance is presented in the Affordable Care Act (ACA) marketplaces, consumers still find it hard to compare health plan costs. They are unfamiliar with plan components, such as premiums, copays, deductibles, coinsurance, and other out-of-pocket expenses, and how these elements form the overall cost of a health plan.3

While consumers are concerned about the cost of health insurance, they also don’t necessarily want the cheapest plan. They want the plan that provides the best value for their needs that they can afford.4 However, consumers have difficulty determining which plan would have the highest value for their expected needs. Consumers are skeptical of their ability to shop for high-value, low-cost healthcare. Without actionable, comparative information about health plan cost and quality, consumers tend to give higher consideration to premiums than to their expected out-of-pocket spending.5

Among the options for constraining health premium growth, consumers prefer that health insurers use more limited physician and hospital networks. In controlled experiments, given accurate information, a variety of options, and a valid structure for weighing the pros and cons, consumers report they prefer to narrow their provider choices in order to preserve or increase medical benefits.6 But this work also shows that consumers assume the narrow networks are high quality and feature sufficient providers for the full range of covered benefits. Other research shows that consumers are increasingly willing to choose a narrow-network plan, especially if their preferred physician is part of the network.7

Many studies show consumers value having options to choose from, but also want a manageable number of plans.8 They don’t want to be overwhelmed with choices.

Consumers also rank choice of doctor, simplified purchasing, credible and impartial comparative information, and having a trusted adviser for health insurance information high in their preferences and needs.9

How Our System Fails Consumers

Navigating health insurance choices is one of the most difficult tasks consumers face and they dread it.

No coverage. Perhaps our greatest failure is instances where we fail to provide consumers with even one viable coverage option-for example, those in the coverage gap in states that did not expand Medicaid.10

Poor coverage. High-deductible health plans, and so-called consumer-directed health plans, are not affordable for many people. They shift more costs onto consumers, especially lower-income and sicker consumers, causing them to forgo needed care. Stakeholders need to comprehensively contain, not shift, rising health costs, and deal with system-wide waste estimated at 30 percent of total health spending. And despite the subsidies available under the Affordable Care Act, many report difficulties finding an affordable health plan.11

The illusion of choice. Health insurance companies hurt consumers by confusing and overwhelming them with too many plan options that feature relatively insignificant differences. One study found that when presented with just two health plan options consumers found it very difficult to make an informed decision due to the large number of health plan features. Several studies of Medicare Part D and Medigap plans found that more options made it harder to choose12 and, as a result, consumers often didn’t make the best choices for their circumstances.13 Presenting complex comparative information greatly decreases consumers’ comprehension of information and reduces their ability to make informed choices.14 Yet this is exactly what we provide.

Failure to provide actionable out-of-pocket cost information. Consumers want to know what they will have to pay out-of-pocket for procedures and services. But because health plan cost sharing is so complex, many consumers default to using premium as their decision-making criteria without understanding the impact of out-of-pocket costs in their circumstances.

Lack of ease of use and simplicity. Consumers know what to expect when they order a product on Amazon or a ride from Uber and wonder why health insurance companies have not caught up in terms of effortlessness and accuracy.

How Can the System Better Meet Consumer Needs?

To truly leverage consumers as shoppers, we must make it easier for them to compare insurance coverage choices. Coverage choices should be restricted to a manageable number, and there should be meaningful differences between the options. Plan features that are allowed to vary should be minimal, in order to make it easier to compare products. For example, states have taken action to simplify plan choice by limiting the number of plans or benefit designs insurers may offer, requiring standardized benefit designs, and adopting meaningful difference standards. Focus groups convened by the Massachusetts Health Connector found that the ideal number of distinct plan designs was six to nine.15 Previous focus group studies found that consumers wanted four to six insurance carrier options within a tier system that indicated low, medium and high levels of overall cost sharing.16

Coverage options should reflect consumer preferences, for example, making costs more predictable by using co-payments instead of coinsurance and covering more services on a pre-deductible basis.17

Once the set of choices has been simplified, consumers prefer information and assistance navigating their health choices from a trusted source. To help healthcare assistors and those comfortable navigating choices on their own, provide consumer-tested, standardized, comparative displays that feature easy-to-understand signals about expected cost-sharing, network quality and breadth,18 and scope of covered benefits. For example, one study found that placing health plan quality data next to cost information and using a checkmark or blue ribbon helped consumers pick high-value plans regardless of their knowledge level.19

Notes

1. Collins, Sara, et al., Who are the Uninsured and Why Haven’t They Signed Up for Coverage?, The Commonwealth Fund, Washington, D.C. (August 2016).

2. Day, Rosemarie, and Pamela Nadash, “New State Insurance Exchanges Should Follow the Example of Massachusetts by Simplifying Choices Among Health Plans,” Health Affairs, Vol. 31, No. 5 (May 2012).

3. Consumers Union, What’s Behind the Door: Consumers’ Difficulties Selecting Health Plans, Washington D.C. (January 2012).

4. Politi, Mary C, et al., “Knowledge of Health Insurance Terminology and Details Among the Uninsured,” Medical Care Research and Review, Vol. 71, Issue 1 (Oct. 24, 2013).

5. Consumers Union, What’s Behind the Door: Consumers’ Difficulties Selecting Health Plans, Washington D.C. (January 2012).

6. Green, Jessica, Judith Hibbard, and Rebecca M. Sacks, “Summarized Costs, Placement of Quality Stars, and Other Online Displays Can Help Consumers Select High-Value Health Plans,” Health Affairs, Vol. 35, No 4 (April 2016).

7. Ginsburg, Marge, Joseph Antos, and Kavita Patel, “Reforming Medicare: What Does the Public Want,” Health Affairs Blog(Nov. 13, 2014).

8. Anand, Pavi, Jenny Cordina, and Suzanne Rivera, Understanding Consumer Preferences Can Help Capture Value in the Individual Market, McKinsey & Company (2016).

9. Quincy, Lynn, and Julie Silas. The Evidence is Clear: Too Many Health Insurance Choices Can Impair, Not Help, Consumer Decision Making. Consumers Union (November 2012). See also: Day, Rosemarie, and Pamela Nadash, “New State Insurance Exchanges Should Follow the Example of Massachusetts by Simplifying Choices Among Health Plans,” Health Affairs, Vol. 31, No. 5 (May 2012).

10. Day, Rosemarie, and Pamela Nadash, “New State Insurance Exchanges Should Follow the Example of Massachusetts by Simplifying Choices Among Health Plans,” Health Affairs, Vol. 31, No. 5 (May 2012).

11. An estimated 2.5 million poor individuals are without health coverage. Garfield, Rachel, and Anthony Damico, The Coverage Gap: Uninsured Poor Adults in States that Do Not Expand Medicaid, The Kaiser Family Foundation (Oct. 2016).

12. Collins, Sara, et al., How the Affordable care Act Has Improved Americans’ Ability to Buy Health Insurance on their Own, The Commonwealth Fund (February 2017).

13. McWilliams, J. Michael, et al., “Complex Medicare Advantage Choices May Overwhelm Seniors – Especially Those with Impaired Decision Making,” Health Affairs (August 2011). See also: Cummings, Janet R, Thomas Rice, and Yaniv Hanoch, “Who Thinks That Part D is Too Complicated? Survey Results on the Medicare Prescription Drug Benefit,” Medical Care Research and Review, Vol. 66, Issue 1 (Sept. 16, 2008).

14. Day, Rosemarie, and Pamela Nadash, “New State Insurance Exchanges Should Follow the Example of Massachusetts by Simplifying Choices Among Health Plans,” Health Affairs, Vol. 31, No. 5 (May 2012).

15. Peters, Ellen, et al., “Less is More in Presenting Quality Information to Consumers,” Medical Care Research and Review, Vol. 64, No. 2 (April 2007).

16. Day, Rosemarie, and Pamela Nadash, “New State Insurance Exchanges Should Follow the Example of Massachusetts by Simplifying Choices Among Health Plans,” Health Affairs, Vol. 31, No. 5 (May 2012).

17. Massachusetts Health Connector, Report to the Massachusetts Legislature – Implementation of Healthcare Reform Fiscal Year 2009, Boston, Mass. (November 2009).

18. Loewenstein, George,et. al. “Consumers’ Misunderstanding of Health Insurance.” Journal of Health Economics 32, no. 5 (September 2013): 850–862.

19. Green, Jessica, Judith Hibbard, and Rebecca M. Sacks, “Summarized Costs, Placement of Quality Stars, and Other Online Displays Can Help Consumers Select High-Value Health Plans,” Health Affairs, Vol. 35, No 4 (April 2016).