Addressing Consolidation in the Healthcare Industry

Consolidation is taking place throughout the healthcare system at an increasing rate. Merging companies often tout benefits including cost savings and increased care coordination, but serious concerns about market power also need to be raised. It is critically important to scrutinize future mergers because of their impact on an already excessively concentrated healthcare marketplace.

This research brief looks at the types of consolidation, the factors driving consolidation, the impact of provider and health plan consolidation on healthcare value, and the role that advocates can play to promote better outcomes for consumers.

Click here to download Research Brief No. 10

What is Consolidation?

Consolidation refers to when two or more companies combine. Specifically, the combination of companies that formerly dealt with or competed with each other, or that potentially could have. Often, the combination is by merger or acquisition and involves transferring the ownership of assets, though it can also be by joint venture or looser “affiliation agreements.” This research brief focuses on the consolidation of hospitals and insurers, although consolidation can and does occur in other healthcare sectors, such as pharmaceutical and medical device manufacturers.

Consolidation can be vertical or horizontal. And the geographic reach can be broad or be limited to a single local area. The level of integration may vary, ranging from full integration of two companies into one to a looser partnership or affiliation between two independently operating companies—a growing trend.

Vertical consolidation or integration, occurs between companies in different lines of work. Often these companies do business with each other or their services complement the other. For example, when a hospital purchases an outpatient center or a health plan merges with a hospital system. Vertical consolidation within healthcare increased 25 percent from 2004 to 2011, with the most growth seen with hospitals buying or partnering with post-acute care facilities.1 This kind of consolidation is often justified as a means to better coordinate care and improve healthcare quality.2 As discussed below, reviews of this type of consolidation are mixed with respect to improvements in care coordination and quality, and any benefits must be balanced against the likely increase in market power.

Horizontal consolidation joins two similar companies, such as two hospitals or two insurers. Horizontal consolidations have also increased. As of 2013, 60 percent of hospitals were part of a larger health system, compared to 53 percent in the 1990s.3 As discussed below, this type of consolidation is closely scrutinized by regulators because of the potential loss of market competition and associated consumer harms.

In addition to product dimension, markets have a geographic dimension. The most likely harm to competition and consumers comes when the consolidation is between two companies operating in the same local service area. But consolidations over broader geographic areas can also be potentially harmful to healthcare and deserve close scrutiny.4

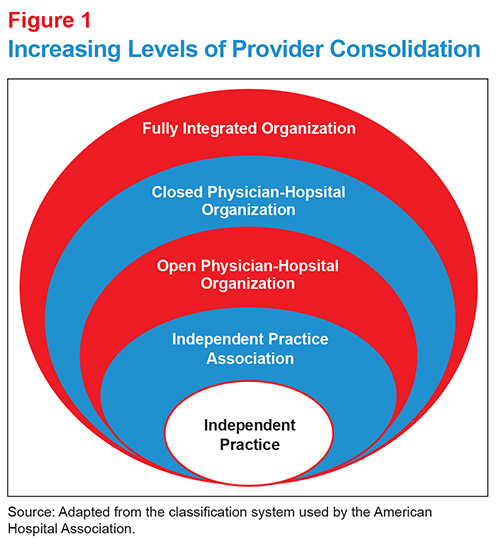

It is important to note that there are different degrees of integration or affiliation that companies may adopt. Based on the classification of provider consolidation used by the American Hospital Association, for example, moving from the least to the most integrated systems, markets may contain independent practices, independent practice associations, open physician-hospital organizations, closed physician-hospital organizations and fully integrated organizations (see Figure 1).5

What’s more, at any level, the integration can involve a transfer of ownership of assets, or it can take the form of a looser affiliation in which hospitals or health systems work together on operational or clinical initiatives, while remaining independent in other respects. Accountable care organizations (ACOs) are vertically integrated structures along this continuum, often making use of affiliation agreements to provide integrated clinical care.

Why do Consolidations Occur?

Several different factors seem to be driving recent consolidation in the healthcare marketplace. The most commonly cited reasons include the desire to gain negotiating power, to offset fixed costs and to navigate the uncertainty surrounding the future of healthcare.

An important motivation for consolidation is to increase negotiating power in insurer-provider contracting. In the private insurance market (representing about 55 percent of all insured people), prices are set through a negotiating process.6 The larger the entity and the fewer number of competitors, the more leverage the entity has over price negotiations. The price of healthcare is highly correlated with the market power held by providers and health plans.7 In this rush to gain negotiating leverage, competition is displaced and the dominant insurers and providers set prices according to what they can demand instead of the quality or underlying cost of the care.8

Fixed costs for healthcare providers represent a large share of expenses. These costs can include capital expenditures, property, utilities, facility maintenance, equipment, and staff salaries and benefits.9 High fixed costs act as a driver for providers to expand horizontally, in order to spread those fixed cost across a greater volume of patients.

Some thought leaders believe the consolidation trend is the result of instability in the market and uncertainty surrounding the future. The current emphasis on coordinated care, low-cost care settings, managed care, changes in payment reimbursement, and the development and pressure to use new costly technologies entice companies into considering the benefits of consolidating. For example, including more physicians into a single health system may be a strategy to ensure a steady stream of patients through self-referrals and the opportunity to spread fixed costs. Additionally, larger provider companies may offer more support and resources for dealing with increasingly complex requirements, including payment methods and reporting requirements. Larger companies may be better able afford staff dedicated to navigating new policies and ensure compliance, compared to smaller practices.

|

How Concentrated? The Herfindahl-Hirschmann Index (HHI) is used to measure levels of concentration within a market, with higher concentration levels meaning less competition. Department of Justice guidelines categorize markets as follows:I

Using this rubric, many health plan and hospital markets in the U.S. are highly concentrated.

The bottom line: when there is too much market concentration, either among hospitals or among health plans, that side has too much leverage at the negotiating table, and ultimately, consumers are harmed by higher prices, restricted choices, and possibly reduced quality in healthcare. You can view health plan concentration in your state at: http://kff.org/state-category/health-insurance-managed-care/insurance-market-competitiveness/ I. U.S. Department of Justice and the Federal Trade Commission, Horizontal Merger Guidelines (Aug. 19, 2010). |

How Does Consolidation Impact Healthcare Value?

Proponents of consolidation claim potential benefits that include:

- cost savings through efficiencies and, sometimes, via a supposed “balancing” of market power,

- improved clinical integration and care coordination,

- higher care quality and better health outcomes, and

- easier acquisition of advanced technology.

However, for the most part, research on consolidation does not support these claims. The majority of research focuses on the impacts of provider consolidation; while limited, research on health plan consolidation suggests a similar lack of benefits.

Findings on Provider Consolidation

Instead of cost savings, most experts believe price increases occur as a result of the increase in market power and the commensurate decrease in competition. Several studies find that areas where hospital services are highly concentrated—where few hospitals compete—correlates to more expensive services. One researcher put it this way: The story of hospital system formation is one of diseconomies of scale.10

|

A Case Study—UnitedHealthcare-Sierra Prior to the 2008 merger of UnitedHealthcare and Sierra Health Services, five large insurance companies operated in Nevada (each with at least five percent of the market). At the time, UnitedHealthcare had the largest market share and Sierra ranked third. The 2008 merger solidified the combined entity’s position as the largest insurer within the state. The impact of the merger on two Nevada markets—Las Vegas and Reno—was analyzed in depth. Researchers found premiums rose due to merger in these markets.25 |

Further, some research suggests that prices increase more steeply when the consolidated entity is a fully integrated provider, compared to when the merged entity exhibits a lower level of integration.11 Moreover, when hospitals merge in markets that are already concentrated, the price increase can be significant—in merged companies and non-merged rival companies as well.12 In 2013, the Federal Trade Commission (FTC) prevented the merger of two Ohio hospitals citing the price variation that existed between providers—the largest entity maintained prices of 32-74 percent higher than other area providers.13

Consolidations within a local market area are more likely to create an excessive concentration of providers, and can lead to higher prices and lower healthcare value for consumers. However, research identifies consolidation as a cost driver even in cases where participating companies operate in different service areas.14

Vertical consolidation—for example, when a hospital merges with a physician group or with a health plan —can also result in price increases.15 Further, vertical consolidation has been found to increase organization complexity, driving costs associated with coordination, information processing and monitoring processes.16 Moreover, research on vertical consolidation has found minimal evidence of improvements in efficiencies.17

Currently available evidence finds that some improvements in the quality of care can occur after provider consolidation. The most significant research shows improved quality as a result of increased volume of specialized services (e.g., a surgical unit specializing in one kind of surgery has better outcomes).18 However, this increase in healthcare quality is estimated to be limited to just a few services, and differs between fully integrated organizations and the looser models of integration.19

In contrast, other evidence suggests quality improvements can be more effectively fostered through provider competition. For example, research on the United Kingdom’s National Health System, where prices are regulated and hospitals compete on quality, found acute myocardial infarction mortality rates decreased associated with higher levels of competition.20

Providers seeking to merge often claim a better ability to innovate. One study suggests that innovation in terms of new work flows and improved cost controls is most common among hospitals that face some financial pressure—in other words, those with more limited market leverage and lower operating margins.21 On the other hand, another study suggests that innovation, in the sense of adopting advanced technology, is primarily associated with higher hospital operating margins.22 In cases of consolidation, if an entity is already considered top quality and in high demand by patients, it has little incentive to innovate its internal processes. However, when it comes to new technologies, profitable hospitals are more likely to adopt. While the adoption of new technologies tends to be interpreted by consumers as improving healthcare quality, it is not clear that an oversupply of new technology benefits consumers and technological change has been cited as a significant cost driver.23

Findings on Health Plan Consolidation

Similar to hospitals, high levels of health plan concentration corresponds to higher premiums. For example, from 2014-2015 the growth of premiums for silver plans in the federal exchanges was eight percent lower in counties that experienced an increase in competition compared to counties that maintained or lost insurers.24

Research is sparser regarding the impact of health plan consolidation on innovation, perhaps reflecting a lack of innovation occurring within the insurance sector. Further, some experts raise the question of whether the consolidation of health plans, and the subsequent increase in market power and ability to squeeze providers financially, actually limits the ability of providers to innovate and provide higher quality care. Although there is no research focused specifically on the impact on providers’ innovation as the result of health plan mergers, a large-scale merger in 1999 between Aetna and Prudential impacted 139 geographic markets in the U.S. resulted in decreased physician salary growth and employment and an increase in nurse employment and salary growth, compared to areas not impacted by the mergers.26

|

Is the ACA Driving Consolidation? Industry entities often cite the Affordable Care Act (ACA) as a primary driver of consolidation, although industry experts are divided. Insurers and providers both suggest the ACA’s policies—including the limitations on denying individuals with pre-existing conditions, reductions in the growth of Medicare hospital reimbursement, rate review, and administrative hassles—have resulted in reduced margins and the need to coordinate care and generate service efficiencies to decrease operating costs.I However, the industry has been consolidating for two decades, suggesting that any effect of the ACA may be modest. Moreover, research does not support claims of cost savings from consolidation.II Finally, the push for new delivery structures (like ACOs) to improve care delivery pre-dates the ACA. In fact, the ACA is credited with spurring modest competition in the individual market because the elimination of underwriting and the standardization of certain plan features has made consumer-driven shopping easier.III I. Christopher M. Pope, How the Affordable Care Act Fuels Healthcare and Market Concentration, Heritage Foundation (Aug. 1, 2014). |

How Can Advocates Address Consolidation?

Advocates need to scrutinize proposed provider and health plan mergers because of the potential impacts on cost, quality and the consumer experience. Moreover, once these mergers are concluded, they cannot generally be unwound, so consumers must live with the impacts for a very long time.

Despite its major impact on healthcare value, consumers and consumer advocates have a limited tool set to address consolidation. These tools include assisting with antitrust and regulatory reviews of proposed mergers, and advocating for increased data transparency. Tools to reduce negative impacts after a merger include payment reform, insurance rate review, tiered-provider networks, hospital rate setting, and potentially other regulatory remedies and post-merger monitoring designed to protect consumer interests.

Pre-Merger Toolset

Antitrust Efforts to Limit Consolidation and Promote Competition

Reviews by the FTC, the Department of Justice (DOJ), the state attorneys general (AG), and sometimes the state insurance commissioners examine proposed mergers to see if they are anti-competitive or, in the case of the insurance commissioners, contrary to the public interest.27 These processes provide avenues for advocates to weigh in, and in the case of state insurance commission reviews, there is often an opportunity for providing input into a public hearing record.

Mergers among hospitals and other providers have garnered increased scrutiny from the FTC since the “boom” of consolidations in the 1990s. With the goal of minimizing price hikes and maximizing quality care through antitrust enforcement, the FTC aims to protect competition, which promotes lower prices, better quality and improved innovation. Mergers involving smaller hospitals in local areas with other options may be less likely to incur antitrust reviews compared to larger hospitals or areas with fewer options; the latter can expect to be subject to more extensive review, perhaps lasting several months.

Insurance mergers go through the same scrutiny, but from the DOJ. Health plan merger reviews are critically important because insurer conduct is largely exempt from the antitrust laws due to the McCarran-Ferguson Act.28 This law makes it more difficult to challenge the anticompetitive activities of insurance companies. As a result, it is all the more critical that regulators complete thorough reviews on proposed insurance mergers so as to prevent concentration that increases the likelihood of anticompetitive activities.

Sometimes, a merger may be given a green light to proceed subject to the condition of certain remedies and post-merger monitoring. These remedies can include structural remedies, such as divestitures, and conduct remedies, such as caps on insurance rates or requirements to grant access to other companies or consumers. The goal of divestitures is to preserve the same amount of competition, in specific market areas, that the merger would otherwise eliminate. Some experts have questioned whether divestitures are really effective in practice.29 Conduct remedies can be used either in lieu of or as a complement to structural remedies. They have been criticized as being of uncertain effectiveness and requiring unrealistic levels of government oversight.30

To help address antitrust concerns, advocates can write letters to ask their elected representatives to encourage a thorough FTC or DOJ review, can encourage their state attorney general or insurance commissioner to undertake their own reviews, and can directly submit comments to the FTC and DOJ. To strengthen and lend credibility to these efforts, advocates can gather concerns regarding both pre- and post-merger activity from other community members, as well as study publicly available reports on market conduct, consumer complaints, pricing and service quality.

Increase Transparency

In general, the fact that much information is kept confidential by the companies proposing to merge limits the research that might give a more thorough understanding of the impacts of consolidation. An increase in transparency would facilitate a more robust measurement of the impact of consolidations and may help inform the needed remedies if the merger is allowed to go forward. Publicly available data, such as that provided by all-payer claims databases, should be available for the public to scrutinize cases of consolidation and the impact on healthcare cost, quality and choice. One tool available to advocates is the Health Marketplace Index report by the Healthcare Cost Institute and the Robert Wood Johnson Foundation. This tool utilizes several metrics, including HHI scores, prices and utilization records to score the economic performance of a number of healthcare markets.

Repeal McCarran-Ferguson

The federal McCarran-Ferguson Act of 1945 generally preempts federal law applying to the business of insurance with state law, and exempts the conduct of the business of insurance from federal antitrust law wherever it is regulated by state law. Because oversight of the insurance industry has essentially been left to the states, it is subject to a patchwork of consumer protection. A few states, like California, New York, and Florida, having active insurance regulators and antitrust enforcers but other states far less so.31 Repealing the McCarran-Ferguson antitrust exemption would give federal antitrust enforcers the same authority to protect competition and consumers in the insurance marketplace that they have in other industry sectors. Several efforts have been attempted over the years to repeal this antiquated antitrust exemption for insurance companies those efforts have been strenuously opposed by the insurance industry.32

Post-Merger Toolset

When markets already feature too much power in the hands of providers or insurers there are reforms and policies that might help address the impact on consumers. However, history tells us that powerful market players can find ways to continue to wield their power to their advantage even under increasingly strong regulatory regimes. Hence, better to preserve competition where it still exists.

Rate Review and the Medical Loss Ratio

Rate Review is the process by which insurance regulators review health insurers’ proposed insurance premiums to ensure they are based on accurate, verifiable data and realistic projections of healthcare costs and utilization. Currently, federal regulations require such a review whenever a carrier proposes an annual premium rate increase in excess of 10 percent, but states have the autonomy to adopt lower thresholds. Further, HHS is tasked with reviewing proposed rates for states that fail to qualify as having an “effective rate review” program. A rigorous rate review, while rare in practice, can provide an opportunity to reduce premiums built on excess pricing.33

Medical Loss Ratio (MLR) limits the portion of the premium dollar that health plans can devote to administration and profit—that is, to expenditures that do not involve paying medical claims or improving the quality of care. Research shows that in the first three years under this regulation, total consumer benefits related to the medical loss ratio—both rebates to consumers when MLR thresholds were not met and savings from reduced overhead—amounted to over $5 billion.34

While rate review and the MLR may be praised as meaningful steps towards providing consumers with affordable healthcare, to date these strategies are not rigorous enough to fully counteract pricing power exercised by powerful hospitals, provider groups, or health plans that dominate the market and hence may have little incentive to extract or pass along savings. Further, the variability with which rate review authority exists among the states, and whether it is carried out assertively, means that consumers in some states must bear the full consequences of mergers while those in neighboring states have access to some relief from their regulators.

Provider Payment Reforms

Currently, reimbursement rates for medical goods and services are determined by provider-insurer negotiations often using a fee-for-service platform. By bundling services together and/or adding quality targets, it might be possible to mitigate some of the adverse effects of provider market power. While techniques such as reference pricing, bundled payments, and pay for performance can be useful tools, these strategies alone cannot be relied on to prevent potential abuses after consolidation.

Narrow Networks/Tiered-Provider Networks/Selective Contracting

Narrow and tiered networks have the potential to steer consumers to high-value providers and lower premium costs, but sufficient consumer protections must be in place to realize these benefits without unduly limiting consumer choice or decreasing healthcare value. Further, for these strategies to work, there need to be many providers in the marketplace with an incentive to compete with one another.

Rate Setting

Hospital rate setting is a rarely used payment approach in which a central body establishes uniform rates for hospital services for multiple payers (insurers). The far more common approach is for hospitals generally negotiate their own rates separately with each payer, including health insurance plans, self-insured employer plans, and uninsured individuals, as well as accepting payments from public payers like Medicaid and Medicare. The result is multiple negotiations and a wide variety of prices in the marketplace. Rate setting still involves some negotiation with hospitals, but with all payers acting as combined entity governed by a public body. Evidence from Maryland’s experience shows that, by having all payers act in concert, this approach can: result in a more informed negotiation process; increase the ability of payment reforms to focus hospitals better outcomes and value, rather than volume of services; potentially lower administrative costs associated with multiple negotiations—all of which generally reduce the adverse consumer impacts associated with provider market power.35

Conclusion

Consolidation is a major cost driver within the U.S. healthcare system. There is little evidence showing that consolidation among healthcare providers or insurers helps achieve system efficiencies, and only limited evidence of improvements in quality. Even in circumstance where efficiencies are realized, experts and history suggest savings will not be passed onto consumers, but instead will be utilized to increase revenues. Despite the significant impact on consumers, advocates have a limited tool set, and access to limited data, to scrutinize the potential impact of consolidations and help prevent harm. More rigorous review of mergers before they are concluded, and increasing the public availability of data to enable closer study of the impact of these mergers, is critically important for ensuring appropriate future policies impacting healthcare quality and cost. In areas of the country where providers and/or health plans are already concentrated, more vigorous use of tools such as rate review, selective provider contracting, and rate setting may have to be employed to combat pricing power.

Notes

1. Cutler, David M, and Fiona Morton, “Hospitals, Market Share, and Consolidation,” JAMA, Vol. 310, No. 18 (November 2013).

2. See www.healthcarevaluehub.org for information on accountable care organizations and patient-centered medical homes.

3. Cutler (November 2013).

4. Baker, Laurence C., et al., “Vertical integration: Hospital ownership of physician practices is associated with higher prices and spending,” Health Affairs, Vol. 33, No. 5 (May 2014).

5. Cuellar, Allison E., and Paul J. Gertler, “Strategic Integration of Hospitals and Physicians,” Journal Of Health Economics, Vol. 25, No. 1 (January 2006).

6. See http://kff.org/other/state-indicator/total-population/

7. See, for example, “The State of Competition in the Healthcare Marketplace: The Patient Protection and Affordable Care Act’s Impact on Competition,” Thomas Greaney, testimony before the Subcommittee on Regulatory Reform, Commercial and Antitrust Law, U.S. House Committee on the Judiciary (Sept. 10, 2015). http://judiciary.house.gov/_cache/files/0a0e88c8-0519-4a47-8fa8-4c2233c760c3/greaney-testimony.pdf

8. Further, the report found that price variations are not correlated to (1) quality of care, (2) the sickness of the population served or complexity of the services provided, (3) the extent to which a provider cares for a large portion of patients on Medicare or Medicaid, or (4) whether a provider is an academic teaching or research facility. Moreover, (5) price variations are not adequately explained by differences in hospital costs of delivering similar services at similar facilities. http://www.mass.gov/ago/docs/healthcare/2010-hcctd-full.pdf

9. This older study found hospital fixed costs could be as high as 84%: Roberts, Rebecca, et al., “Distribution of Variable vs. Fixed Cost of Hospital Care,” JAMA, Vol. 281, No. 7 (Feb. 17, 1999). See also: http://www.fiercehealthcare.com/story/hospitals-fixed-costs-drive-healthcare-expenditures/2013-10-07

10. Burns, Lawton Robert, et al., “Is the System Really the Solution? Operating Costs in Hospital System,” Medical Care Research and Review (April 22, 2015).

11. Baker (May 2014).

12. Dafny, Leemore, “Estimation and Identification of Merger Effects: An Application to Hospital Mergers,” Journal of Law and Economics, Vol. 52, No. 3 (2009).

13. For more information, see: http://www.ca6.uscourts.gov/opinions.pdf/14a0083p-06.pdf

14. Lewis, Matthew S., and Kevin E. Pflum, “Diagnosing Hospital System Bargaining Power in Managed Care Networks,” American Economic Journal: Economic Policy, Vol. 7, No. 1 (February 2015).

15. Academy Health, Integration, Concentration, and Competition in the Provider Marketplace, Washington, D.C. (December 2010). Neprash, Hannah T., et al., “Association of Financial Integration Between Physicians and Hospitals with Commercial Healthcare Prices,” JAMA Internal Medicine (October 2015).

16. Goldsmith, Jeff, et al., Integrated Delivery Networks: In Search of Benefits and Market Effects, National Academy of Social Insurance, Washington, D.C. (February 2015).

17. Cuellar, Allison E., and Paul J. Gertler, “Strategic Integration of Hospitals and Physicians,” Journal Of Health Economics, Vol. 25, No. 1 (January 2006); and Cutler (November 2013).

18. Birkmeyer, John D., et al., “Surgeon Volume and Operative Mortality in the United States,” New England Journal of Medicine (November 2003).

19. Ibid.

20. Cooper, Zach, et al., “Does Hospital Competition Save Lives? Evidence from the English NHS Patient Choice Reforms,” The Economic Journal (August, 2011).

21. Stensland, Jeffrey, Zachary R. Gaumer and Mark E. Miller, “Private-Payer Profits Can Induce Negative Medicare Margins,” Health Affairs, Vol. 29, No. 5 (2010).

22. Ladapo, Joseph A., et al., “Adoption and spread of new imaging technology,” Health Affairs, Vol. 28, No. 6 (2009).

23. Kaiser Family Foundation, Snapshots: How Changes in Medical Technology Affect Healthcare Costs (March 2, 2007).

24. Department of Health and Human Services, Competition and Choice in the Health Insurance Marketplaces 2014-2015: Impact on Premiums (July 2015).

25. Guardado, Jose R., David W. Emmons and Carol K. Kane, “The Price Effects of a Large Merger of Health Insurers: A Case Study of UnitedHealth Sierra,” Health Management, Vol. 1, No. 3 (2013).

26. Dafny, Leemore, Duggan, Mark and Subramaniam Ramanarayanan, “Paying a Premium on Your Premium? Consolidation in the U.S. Health Insurance Industry,” American Economic Review, Vol. 102, No. 2 (2012).

27. Healthcare Value Hub, A Primer: How Antitrust Law Affects Competition in the Healthcare Marketplace, Research Brief No. 4 (April 2015).

28. A federal law exempting the conduct of the business of insurance markets from most federal law, including antitrust law, where there is state regulation. 15 U.S.C. 1011-1015.

29. John Kwoka, Mergers, Merger Control and Remedies: A Retrospective Analysis of U.S. Policy, MIT Press (2015).

30. Breed, Logan M., and David J. Michnal, “Merger Remedies: The DOJ’s New Guide to Old Differences with the FTC,” Antitrust Magazine (Spring 2005).

31. Balto, David, and Stephanie Gross, Don’t Leave It to the States: Leaving Health Insurance Oversight to State Regulators is a Dangerous Idea, Center for American Progress (Oct. 22,2009).

32. National Law Review, Congress Begins With Renewed Efforts to Repeal Insurer’s Antitrust Exemption (March 3, 2015).

33. See https://www.healthcarevaluehub.org/advocate-resources/publications/health-insurance-rate-review/

34. McCue, Michael J., and Mark A. Hall, Realizing Health Reform’s Potential: The Federal Medical Loss Ratio Rule: Implications for Consumers in Year 3, The Commonwealth Fund (March 2015).

35. Healthcare Value Hub, Hospital Rate Setting: Promising, but Challenging to Replicate, Research Brief No. 1 (March 2015).